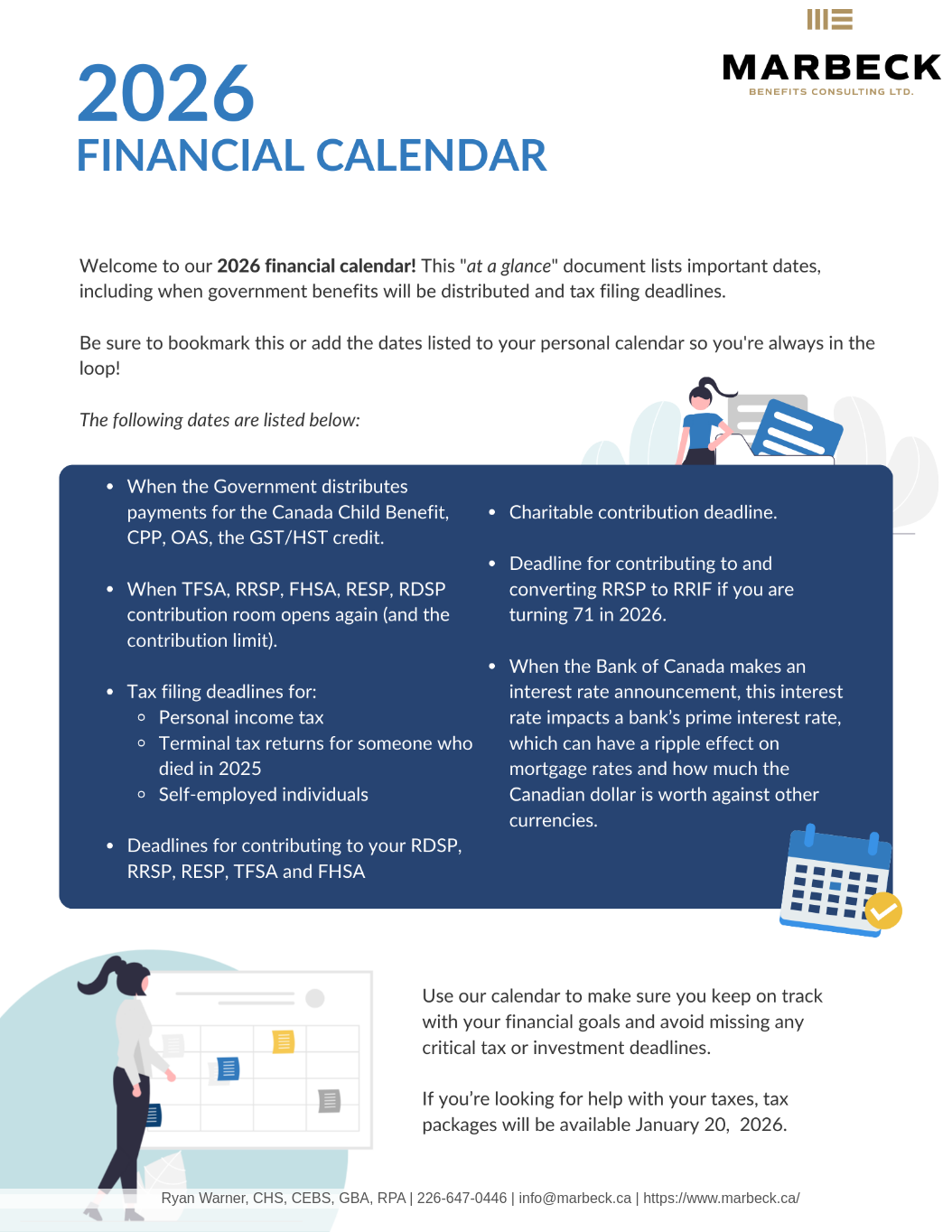

2026 Financial Calendar

Welcome to our 2026 financial calendar!

This calendar is designed to help you keep track of important financial dates and deadlines, such as tax filing and government benefit distribution. You can bookmark this page for easy reference or add these dates to your personal calendar so you don’t miss any important financial obligations.

If you need help with your taxes, 2025 income tax packages will be available starting January 20, 2026. Don’t wait until the last minute to get started on your tax return – make an appointment with your accountant so you’re ready when tax season arrives.

Important Dates to Know

On January 1, 2026, the contribution room for your Tax-Free Savings Account (TFSA) opens again. The TFSA dollar limit for 2026 is $7,000.

For those who are eligible, the contribution room for your:

Registered Retirement Savings Plan (RRSP)

First Home Savings Account (FHSA)

Registered Education Savings Plan (RESP)

Registered Disability Savings Plan (RDSP)

will also be available for the 2026 calendar year.

RRSP Deadline (for the 2025 Tax Year)

For your Registered Retirement Savings Plan (RRSP) contributions to be eligible for the 2025 income tax year, you must make them by:

March 2, 2026

Contributions made after this date will generally count toward your 2026 tax return.

GST/HST Credit Payment Dates

GST/HST credit payments will be issued on:

January 5

April 2

July 3

October 5

Canada Child Benefit (CCB) Payment Dates

Canada Child Benefit payments will be issued on:

January 20

February 20

March 20

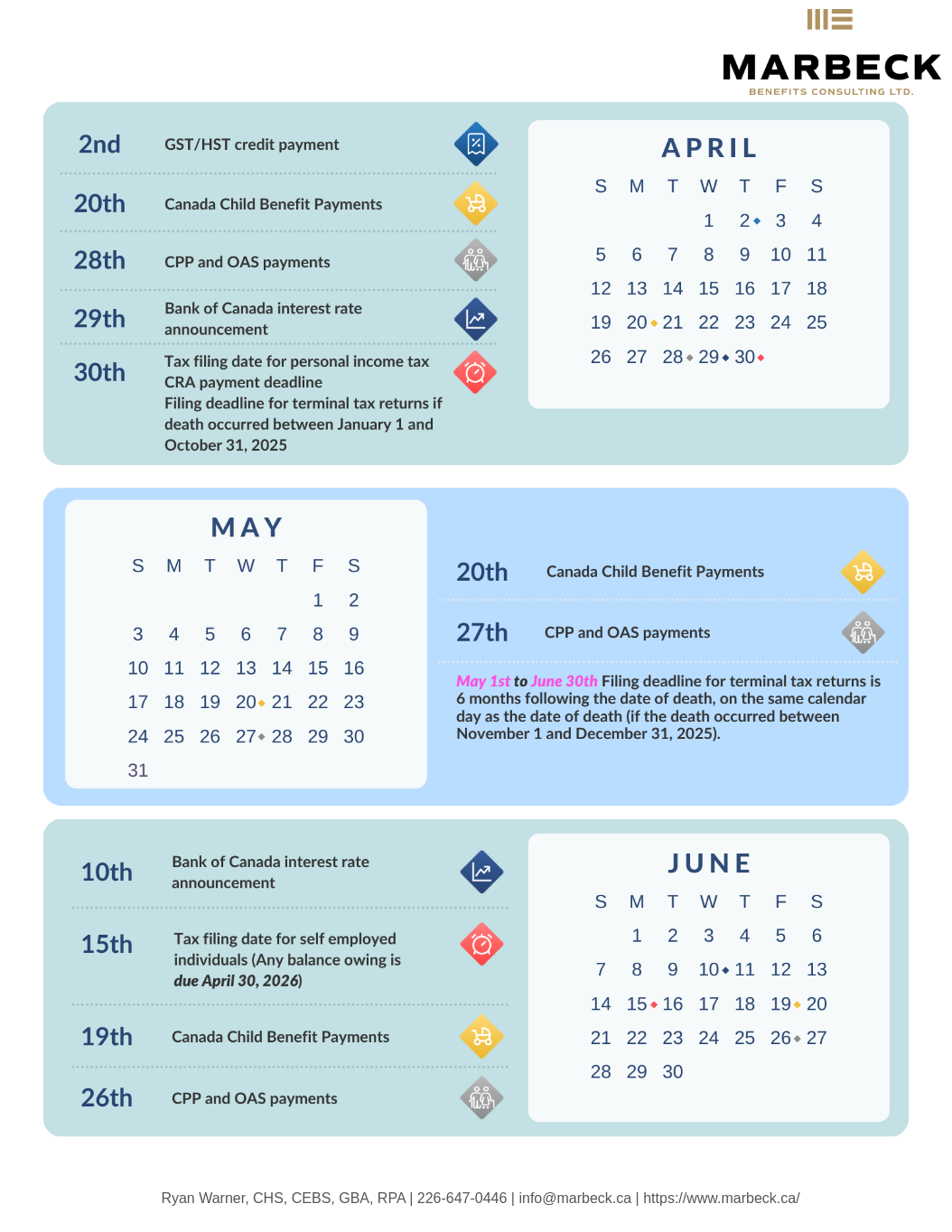

April 20

May 20

June 19

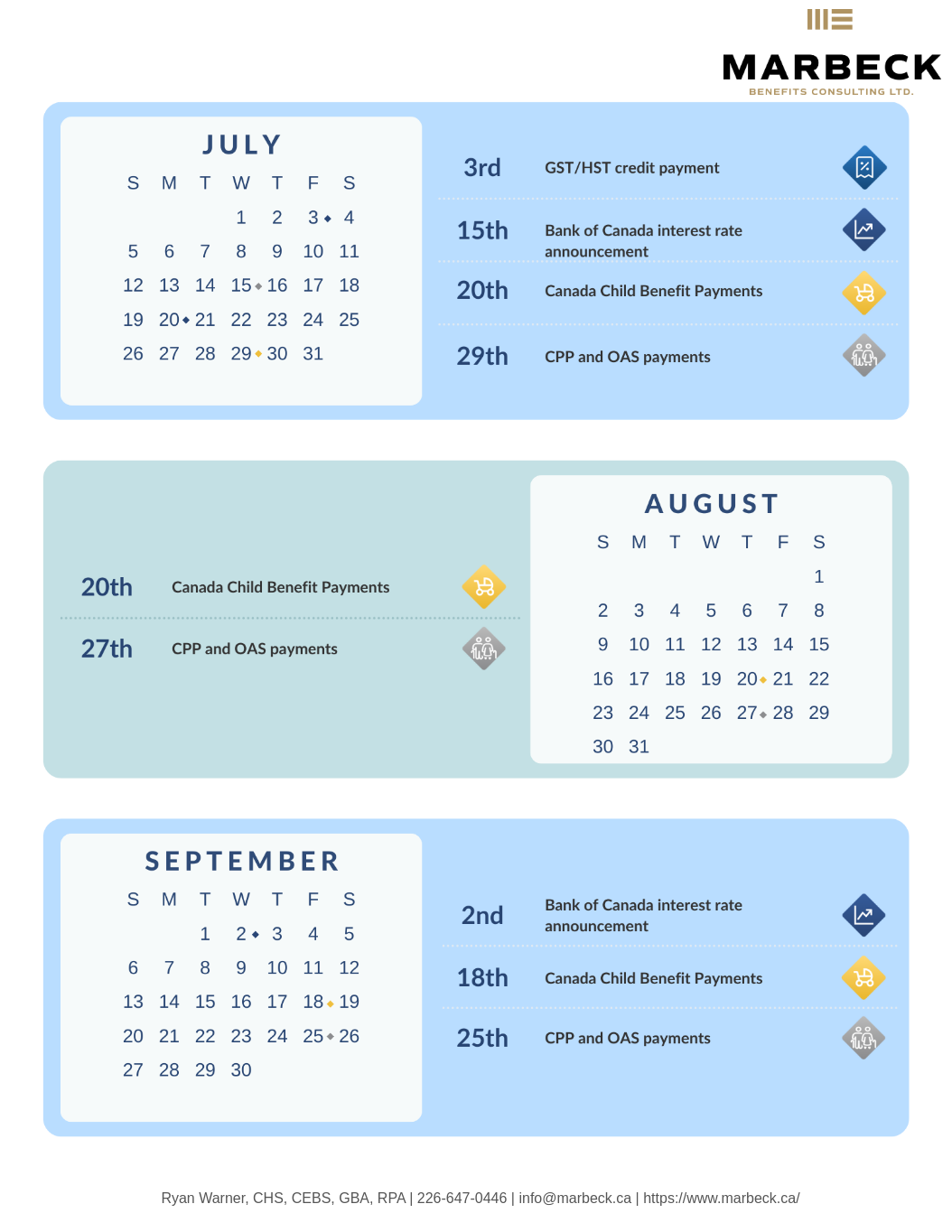

July 20

August 20

September 18

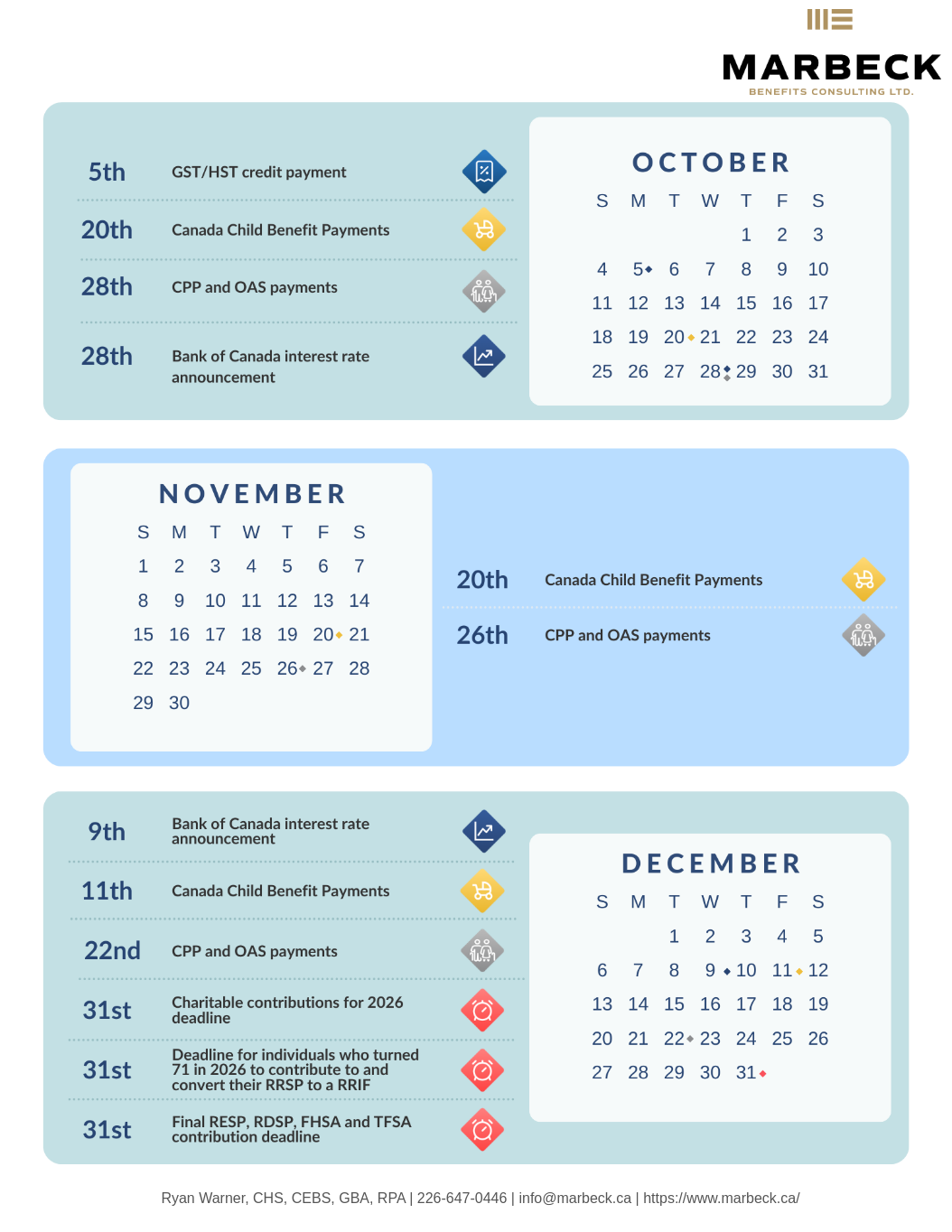

October 20

November 20

December 11

Canada Pension Plan (CPP) and Old Age Security (OAS)

The government will issue Canada Pension Plan (CPP) and Old Age Security (OAS) payments on the following dates:

January 28

February 25

March 27

April 28

May 27

June 26

July 29

August 27

September 25

October 28

November 26

December 22

Bank of Canada Interest Rate Announcements

The Bank of Canada will make interest rate announcements on:

January 28

March 18

April 29

June 10

July 15

September 2

October 28

December 9

Personal Income Tax Deadlines

For most individuals, April 30, 2026 is the last day to:

File your 2025 personal income tax return, and

Pay any balance owing on your 2025 taxes.

This is also generally the filing deadline for final returns if death occurred between January 1 and October 31, 2025.

If death occurred between November 1 and December 31, 2025, the filing deadline for the final return is six months after the date of death (which will fall between May 1 and June 30, 2026).

Self-Employment Tax Deadlines

If you or your spouse/common-law partner are self-employed:

The filing deadline for your 2025 tax return is June 15, 2026.

Any tax payments owing are still due by April 30, 2026.

Filing later than these dates may result in interest and penalties.

Year-End Contribution Deadlines

The final contribution deadline for the 2026 calendar year for the following accounts is December 31, 2026:

Tax-Free Savings Account (TFSA)

First Home Savings Account (FHSA)

Registered Education Savings Plan (RESP)

Registered Disability Savings Plan (RDSP)

December 31, 2026 is also the deadline for:

Making 2026 charitable donations that you want to claim on your 2026 tax return.

Individuals who turn 71 in 2026 to:

Make their last contributions to their own RRSPs, and

Convert their RRSPs to RRIFs (or an annuity).

Please reach out if you have any questions or would like help planning around any of these dates.

Sources:

Canada Revenue Agency. Tax-Free Savings Account (TFSA), Guide for Individuals. RC4466 (E), Canada.ca, https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4466/tax-free-savings-account-tfsa-guide-individuals.html.

Canada Revenue Agency. “Registered Retirement Savings Plan (RRSP).” Canada.ca, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/registered-retirement-savings-plan-rrsp.html.

Canada Revenue Agency. “Registered Education Savings Plans (RESPs).” Canada.ca, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps.html.

Canada Revenue Agency. “First Home Savings Account (FHSA).” Canada.ca, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html.

Canada Revenue Agency. “GST/HST Credit – Payment Dates.” Canada.ca, https://www.canada.ca/en/revenue-agency/services/child-family-benefits/gst-hst-credit/payment-dates.html#toc1.

Canada Revenue Agency. “Benefit Payment Dates.” Canada.ca, https://www.canada.ca/en/revenue-agency/services/child-family-benefits/benefit-payment-dates.html.

Canada. “Benefit Payment Dates Calendar.” Canada.ca, https://www.canada.ca/en/services/benefits/calendar.html.

Bank of Canada. “Bank of Canada Publishes 2026 Schedule for Policy Interest Rate Announcements and Other Major Publications.” Bank of Canada, https://www.bankofcanada.ca/2025/08/bank-canada-publishes-2026-schedule-policy-interest-rate-announcements-other-major-publications/.

Canada Revenue Agency. “Important Dates – Individuals.” Canada.ca, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/important-dates-individuals.html.

Canada Revenue Agency. “Important Dates for RRSPs, RRIFs, and RDSPs.” Canada.ca, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/important-dates-rrsp-rrif-rdsp.html.