Smart Benefits: Health and Wellness Accounts

Running a business in Canada involves balancing expenses, employee satisfaction, and adapting to the evolving benefits landscape. As healthcare costs rise and workplace wellness becomes increasingly important, many business owners seek effective ways to support their employees without incurring unsustainable costs.

Health and Wellness Spending Accounts offer flexible, customizable benefits that can help you:

- Provide meaningful support to your team

- Reduce taxable income

- Offer personalized coverage that meets diverse employee needs

If you're considering enhancing your benefits strategy, here's what you need to know.

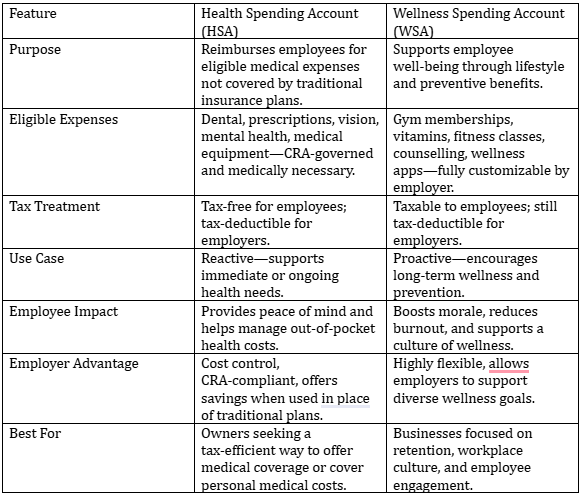

Understanding the Difference: HSA vs. WSA

Both HSAs and WSAs are employer-funded benefit tools, but they serve different purposes.

Health Spending Accounts (HSAs):

- Purpose: Reimburse employees for eligible medical expenses not covered by traditional insurance plans.

- Eligible Expenses: Include dental care, prescription drugs, mental health services, vision care, and some insurance premiums.

- Tax Impact: Covered expenses are not included in employees' taxable income, and the amounts paid by the business can be claimed as a deductible expense.

- Governance: Expenses must align with Canada Revenue Agency (CRA) guidelines.

Wellness Spending Accounts (WSAs):

- Purpose: Support overall well-being through coverage of lifestyle and preventive expenses.

- Eligible Expenses: Can include gym memberships, fitness classes, nutritional counseling, stress management programs, and more.

- Tax Treatment: Reimbursements are considered taxable income for employees but remain tax-deductible for employers.

- Plan Flexibility: Business owners can define which wellness-related costs are covered, creating a program that aligns with their team’s specific needs.

Health Spending Account vs. Wellness Spending Account

Why More Business Owners Are Using Spending Accounts

HSAs and WSAs offer:

Cost Predictability: Set annual maximums to control benefits spending.

Flexibility: Customize eligible expenses to align with employee needs and company culture.

Supplement to Traditional Plans: Many employers use HSAs/WSAs to top up traditional group coverage—adding flexibility and covering expenses where employees need it most.

Employee Satisfaction: Provide personalized benefits that can enhance morale and retention.

How It Works

1. Choosing a Provider: Many insurance providers offer these accounts as add-ons.

2. Allocating Funds: Decide how much to allocate per employee annually (e.g., $1,500 for HSA and $500 for WSA).

3. Reimbursement Process: Employees submit receipts for eligible expenses and receive reimbursements, subject to plan guidelines.

Getting Started

- Assess Needs: Evaluate your team's needs and preferences.

- Select a Provider: Choose a provider that offers the level of customization and support you require.

- Communicate: Clearly explain the benefits and usage of the accounts to your employees.

- Monitor and Adjust: Regularly review the program's effectiveness and make adjustments as needed.

Conclusion

Health and Wellness Spending Accounts provide Canadian business owners with flexible, tax-efficient tools to support their employees' health and well-being. By offering these benefits, you can enhance employee satisfaction, control costs, and create a supportive workplace culture.

Need help applying this to your situation? Book a quick call with our team.

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or tax advice. Always consult a qualified professional regarding your specific situation. We are not responsible for any actions taken based on this content.

Sources

Health Spending Accounts – CRA Guidelines – https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/health-spending-accounts.html

Eligible Medical Expenses – Canada.ca – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-33099-33199-eligible-medical-expenses-you-claim-on-your-tax-return.html

Canada Revenue Agency. Employers’ Guide – Taxable Benefits and Allowances. Government of Canada, 2024. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4130/employers-guide-taxable-benefits-allowances.html

Canada Revenue Agency. Recreational Facilities and Club Dues. Government of Canada, 2024. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances/recreational-facilities-club-dues.html

Canada Revenue Agency. Benefits and Allowances Chart. Government of Canada, 2024. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances/benefits-allowances-chart.html

Financial Consumer Agency of Canada. Plan Your Workplace Financial Wellness Program. Government of Canada, 2023. https://www.canada.ca/en/financial-consumer-agency/services/financial-wellness-work/plan.html